Small businesses are mighty. They're considered the backbone of the American economy and the heartbeat of many communities.

While they're particularly vulnerable to market headwinds—think the economic fallout from the COVID-19 pandemic, rising inflation, and the impact of tariffs on parts and labor—small businesses are also more nimble than their behemoth counterparts.

And unlike corporate giants like Target and Walmart, which sell the same products from coast to coast, small businesses can curate inventory to their communities and utilize local resources—whether that's a cafe in the Catskills featuring fresh, local ingredients; a gift shop in Austin, Texas, featuring products from local artisans; or a renewable energy startup in Midland harnessing wind power.

Small businesses, defined by the Small Business Administration as establishments with fewer than 500 employees, are responsible for almost 44% of the nation's gross domestic product and employ roughly half of the private sector jobs. They're also major drivers of job creation: Since 2019, small businesses have accounted for more than 70% of net job creation, according to a 2024 Treasury Department report.

Although the SBA deems businesses small if they have fewer than 500 employees, about half of small businesses have only one to four employees, according to a Pew Research Center report based on the Census Bureau's Annual Business Survey. These smaller businesses, sometimes known as microenterprises, have an advantage: As industries evolve and grow, they can pivot or launch quickly, sometimes with little overhead. That can fuel productivity and innovation, prompting bigger companies to keep pace, according to the U.S. Chamber of Commerce.

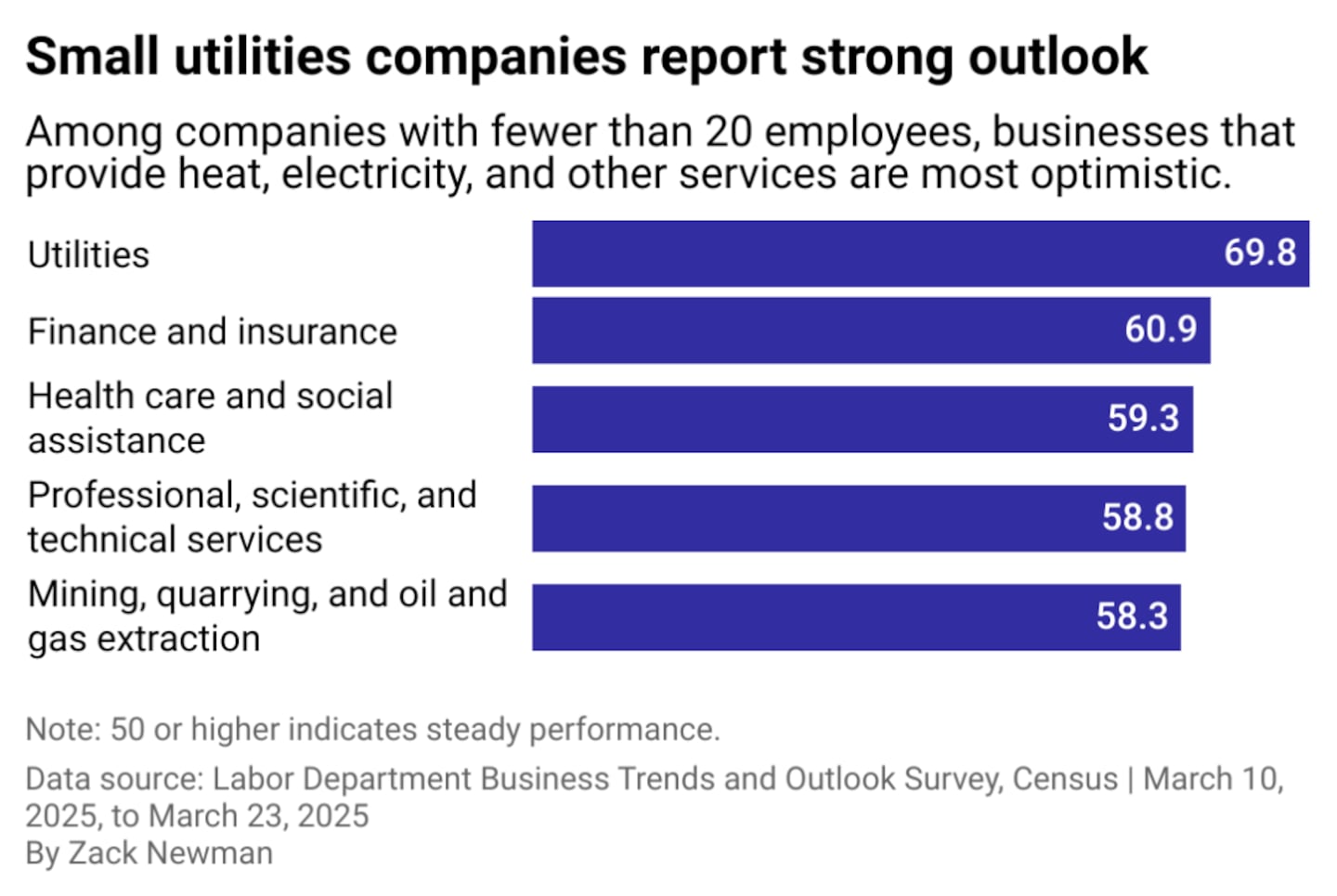

CheapInsurance.com used the Census' Business Trends and Outlook Survey to determine which industries are seeing the most growth among businesses with 20 employees or fewer. The survey sampled approximately 1.2 million businesses biweekly and collected responses from March 10 through March 23.

CheapInsurance.com

Utilities, finance and insurance, and health care are top sectors for small businesses

When looking only at businesses with fewer than 20 employees, a handful of sectors saw performance improvement, according to an analysis of Census data. The utilities field performed the best, followed by the combined finance and insurance sector, plus health care.

This is fueled by growing demand reported by the utilities sector. The number of employees declined slightly in every reported sector except for the utilities sector, which increased slightly. The typical number of reported paid hours worked also held steady.

Revenue decreased in almost every sector, especially in transportation and warehousing and retail trade, except for utilities. Companies in the utilities realm reported stable revenue.

Deloitte's 2025 Power and Utilities Industry Outlook shows that high performance by businesses in the utilities industry stems from growing demand for power. This surge is driven by the rapid growth of data centers—spurred by technologies like generative artificial intelligence, machine learning, and cryptocurrency mining, which are quickly becoming major electricity consumers.

Utilities lead the charge, while others struggle with revenue drops

Small businesses within health care and social assistance, the third-highest ranking sector, are also poised for growth. Private home care agencies, many of which are classified as small businesses, made up 25,700 firms employing 1.5 million workers at the end of 2024, according to the SBA. Jobs for home health and personal care aides are expected to increase by 21% between 2023 and 2033, much faster than average, according to the Bureau of Labor Statistics' Occupational Outlook Handbook, meaning home care agencies will have a growing pool of employees.

Within the finance and insurance sector, a swath of jobs, including accountants and budget analysis, is seeing an uptick.

The utilities, mining, and finance sectors had the most optimistic outlook on future performance, according to Census data, with the fields reporting the highest levels of predicted demand. Mining and construction companies, in particular, reported they were more likely to hire more employees, a sign of potential growth.

While these high performers are poised for growth, small businesses in other sectors are experiencing a decline. An escalating trade war spurred by sweeping tariffs threatens to upend the global economy. Even before President Donald Trump's latest round of proposed tariffs was levied in April, the food and retail sectors had the lowest performance of all sectors, according to Census data.

Tariffs and uncertainty weigh heavily on other industries

The number of employees at businesses with one to nine employees has cratered since March 2024 and is down more than a million as of March 2025, according to the Intuit QuickBooks Small Business Index.

The National Federation of Independent Business reported the "net percent of owners expecting better business conditions" fell from February to March, the "largest monthly decline since December 2020."

Consider the impact of the proposed tariffs on an online stationery business, Simplified, whose owner, Emily Ley, will have to pay hundreds of thousands of dollars more to get products, she told CBS News.

"This additional tax burden is catastrophic to our business," Ley said. "We've already raised our prices as much as possible to absorb previous tariff increases. There's a limit to how much we can increase prices before we price ourselves out of the market."

What happens next, however, is anyone's guess. While economic uncertainty, increasingly pessimistic consumer sentiment, and tariffs that whipsaw from one day to the next have shaken small businesses in some ways, new technology has leveled the playing field in others. Tools that cut costs, the rise of remote work, and an increase in personalized products and services have pushed small businesses to innovate even amid constraints.

While the sectors that might thrive tomorrow are hard to pin down, small businesses will remain the heart of their communities.

Story editing by Alizah Salario. Copy editing by Yvonne Ngai-Fodge.

This story was produced by Cheap Insurance and was produced and distributed in partnership with Stacker.